Asian stocks tumbled Wednesday as investors recoiled from mounting doubts about the AI boom, after U.S. tech shares sank on fears that valuations in the sector have run too far ahead of profits.

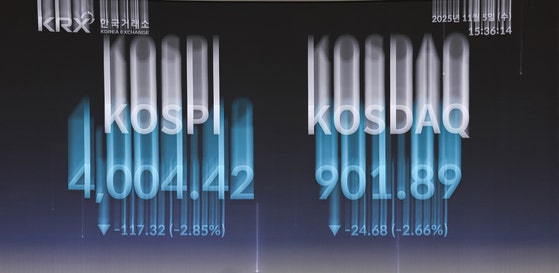

Korea’s benchmark Kospi fell more than 6 percent during the session, briefly breaking below 3,900 before closing just above the 4,000 mark. Japan’s Nikkei 225 likewise slid over 4 percent, breaching the 50,000 level, while Taiwan’s Taiex dropped 1.42 percent and Hong Kong’s Hang Seng slipped 0.07 percent.

The won weakened sharply against the greenback to reach a seven-month low. It was quoted at 1,449.4 won per dollar at 3:30 p.m., up 0.8 percent from the previous session, as foreign investors pulled out of local equities.

The sell-off followed a steep drop in U.S. AI software maker Palantir Technologies, which plunged nearly 8 percent on Tuesday in New York trading despite reporting record quarterly earnings. The company’s third-quarter revenue rose to $1.18 billion, its highest ever. But the surge in its share price this year outpaced earnings growth, stoking valuation concerns.

Palantir’s stock has soared 152.2 percent in 2025, pushing its forward price-to-earnings ratio (P/E) above 200.

Jay Hatfield, chief executive of Infrastructure Capital Advisors, said investors have already priced in much of AI’s promise, and now they expect companies to deliver tangible results. He added that even strong earnings growth may not justify a valuation as high as 200 times projected profit.

Oracle, another major AI-related stock, fell 3.75 percent after gaining nearly 49 percent this year, with its forward P/E above 30. AI chip leaders Nvidia and AMD each slid around 4 percent. According to FactSet, the Nasdaq’s forward P/E stood near 30, well above the 10-year average of 25.

The bubble fears intensified after Michael Burry, head of Scion Asset Management and the investor portrayed in “The Big Short” (2015), was revealed to have taken bearish positions on Palantir and Nvidia.

The Financial Times reported that Scion held $912 million in put options on Palantir and about $1.87 billion on Nvidia as of late September.

“Sometimes, we see bubbles,” Burry wrote in a recent X post. “Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.”

Skepticism about AI valuations stems from limited evidence of the technology delivering meaningful profits to date. A Massachusetts Institute of Technology study of 153 firms adopting generative AI in the first half of this year found that 95 percent saw no significant revenue gains.

A Korean fund manager, speaking on condition of anonymity, said: “OpenAI is valued at $500 billion but posted a $5 billion loss last year. The gap between investment and measurable results is still wide.”

Still, many analysts argue that AI hype hasn’t reached dot-com levels.

“In the early 1990s, U.S. investment in information-processing equipment rose from just above 2 percent of GDP to 2.9 percent by 2000 — an increase of 0.9 percentage points,” said Kim Jae-seung, an analyst at Hyundai Motor Securities. “By comparison, [with the same conditions] today’s increase is roughly half that.”

Kim added that growing investment in IT infrastructure will inevitably boost related corporate earnings.

Park Sang-hyun, an analyst at iM Securities, said it’s “too early to call this a bubble,” given large-scale AI investments by the U.S. and China and the rapid mainstreaming of generative AI.

Even so, more Wall Street strategists are warning of a market correction. Global equities have surged this year, and expectations for U.S. rate cuts have dimmed.

“We should welcome the possibility that there would be drawdowns, 10 percent to 15 percent, that are not driven by some sort of macro cliff effect,” said Morgan Stanley CEO Ted Pick at the Global Financial Leaders’ Investment Summit in Hong Kong.

Goldman Sachs CEO David Solomon, speaking at the same panel, forecast that there would likely be a “10 to 20 percent drawdown in equity markets sometime in the next 12 to 24 months.”

This article was originally written in Korean and translated by a bilingual reporter with the help of generative AI tools. It was then edited by a native English-speaking editor. All AI-assisted translations are reviewed and refined by our newsroom.

댓글목록

등록된 댓글이 없습니다.